Nebraska is unique among Midwest States in that it uses the Classified Use method for valuing agriculture land. This method creates challenges for Assessors as it can be very time-intensive process of “counting dots” to determine the acreage of each land use and soil combination in a parcel. Not only could this process take hours, it was error-prone and subjective – an Assessor could do this process three times and get three different results! Read more about how land is valued in Nebraska.

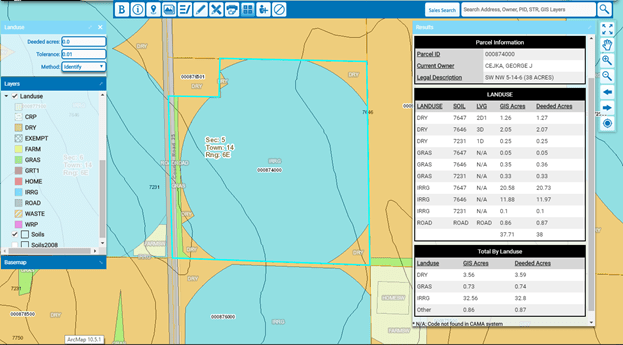

gWorks created the Land Use Calculator Tool more than 10 years ago that allows Assessors to do this spatial analysis accurately within seconds for each parcel. The Land Use Calculator Tool is available to Assessors who work with gWorks as either a web-based tool or a tool to use within ArcGIS Desktop. It requires a parcel layer, a Land Use layer, and a soils layer.

What does the Land Use Calculator Tool do?

The Tool calculates the acreage of each land use, soil, and corresponding LCG combination. It provides both the Deeded acres and actual GIS acres for each combination that can then be entered into a County’s Computer-Assisted Mass Appraisal (“CAMA”) database for valuation land.

Best practice: An Assessor needs to run the Land Use Calculator Tool on a parcel every time the soils or Land Use change and re-enter that acreage in their CAMA database to ensure accuracy in acres and ultimately valuation.

Based on the nearly 100 counties we work with, gWorks estimates the Land Use Calculator Tool saves over 250 labor hours per year for each client that would otherwise be spent counting dots or manually doing spatial analysis. In addition to saving time, this method of valuing land is more accurate, fair, equitable, and could potentially bring additional tax revenue to your County.

- Phelps County: “We increased assessed acres through accuracy in land use calculations.”

- Cuming County: “I have confidence in my valuations when dealing with property owners because we can SEE how the value was determined. I also use my land use calculator to compare deeded acres vs. GIS acres to identify inaccuracies in assessment.”

- Colfax County: “Our GIS has paid for itself many times over” by using imagery along with GIS to identify new buildings and to correct land use.

Additional Features

Additional configuration to the Land Use Calculator Tool is also available. For example, Assessors can set a tolerance threshold so that the Tool can ignore any small slivers of a particular land use and soil combination that are smaller than a certain size. By default, this is set to ignore anything smaller than .01 acres, but this is adjustable by each Assessor. In addition, Assessors can use a “draw” function to draw out an estimated parcel and get the land use and soils breakdown. This is useful if someone is planning on splitting out part of a parcel and would like to know an estimated value of that new parcel.

gWorks has also worked in collaboration with the CAMA vendor MIPS to provide a more automated way to import the resulting LCG acreages back into their CAMA system so the numbers don’t have to be typed in manually. To set up this export functionality, Assessors must first work with MIPS and then can contact gWorks to enable the export functionality.

For more information on the Land Use Calculator Tool, its capabilities, or automated importing, please contact us at 402-436-2150 or email us at info@gworks.com.